A sound and dynamic tax system is a critical factor for economic development including job creation, social welfare, better standard of living. At the heart of this is the need for a clear and robust tax policy framework which must be properly implemented.

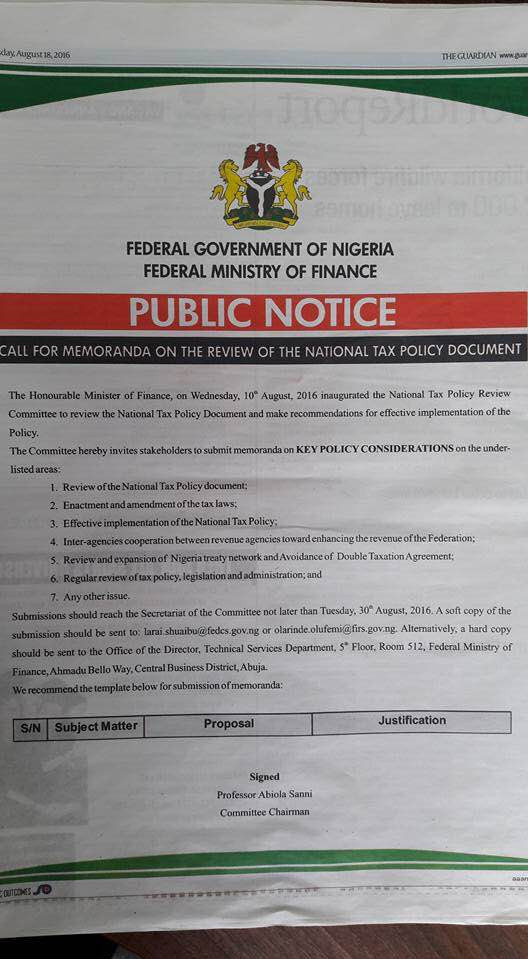

Nigeria's current National Tax Policy was approved in 2010 but has barely been implemented . To address this, the Minister of Finance recently set up a committee to review the Policy and make recommendations for effective implementation.

Areas of focus include key policy considerations regarding the following:

Review of the National Tax Policy document;

Enactment and amendment of the tax laws;

Effective implementation of the National Tax Policy;

Ensuring inter-agencies cooperation between revenue agencies toward enhancing the revenue of the Federation;

Review and expansion of Nigeria treaty network and Double Taxation Agreement regime;

Regular review of tax policy, legislation and administration; and

Any other issue.

Below is a copy of the invitation for input from all stakeholders for your action. I have also attached a copy of the existing tax policy for your reference.

Join the conversation, participate and contribute. Together we can make Nigeria great!

Recent Comments